Energy market update: September 2025

Tailored newsletters for you

Sign up to our newsletter to receive further information and news tailored to you.

In a volatile and developing market, Carter Jonas’ brokerage platform helps clients to find the best PPA price for your export, supply as well as options for sleeved PPAs and gas and electric supply contracts.

See below for this week's latest on the UK & EU gas, UK power & renewables and the oil & carbon markets, in partnership with PPAYA. To discuss options please contact Helen Moffat or Jamie Baxter.

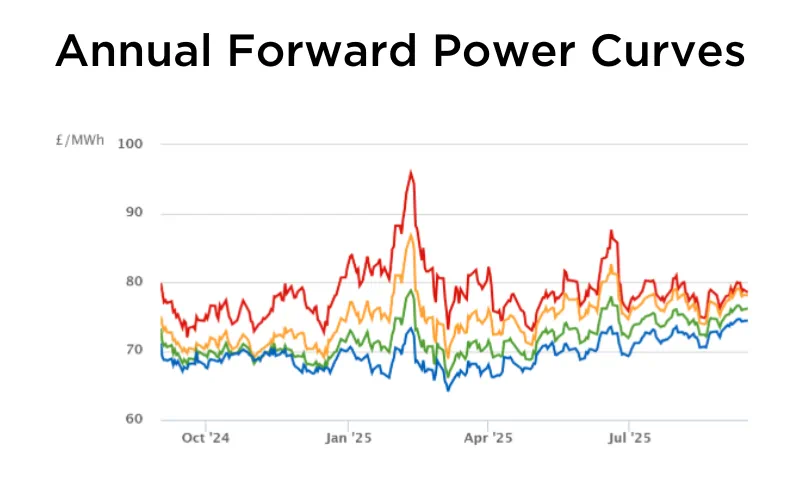

Annual forward power curves - Sep 25

Markets edged higher during yesterday’s session as forecasts indicated falling temperatures and reduced wind output early next week, boosting sentiment that gas demand will rise. Domestic fossil fuel generation is currently producing around 4.5 GW, meeting approximately 15% of UK demand this morning.

Traders are closely monitoring the UK as President Trump arrived yesterday on his second state visit. There is anticipation that he may provide comments on Ukraine peace negotiations, global tariffs, and Russian sanctions.

AGSI+ reports that aggregated EU gas storage levels stand at 80.83%, leaving the bloc well stocked ahead of the winter delivery period and on track to reach fullness targets by the end of the month. UK gas storage is at 46.96%, with only one LNG vessel scheduled to arrive at UK terminals over the next fortnight.

In terms of electricity, domestic demand currently stands at 31.7 GW, with renewables supplying around half of total generation. Wind remains the leading source at 15.16 GW, covering approximately 47.8% of supply. Revised forecasts indicate that wind output will be volatile over the remainder of the week, with several dips expected; a decline to below seasonal norms is forecast for mid-next week.

Get in touch

- Loading...

- Loading...

Tailored newsletters for you

Sign up to our newsletter to receive further information and news tailored to you.