Living sectors

Our in-house Living Sector experts provide a range of bespoke services to investors, housebuilders, developers and operators. We have genuine and extensive experience across the entire Living Sector lifecycle, enabling us to maximise efficiency and return on investment for our clients.

Overview

The UK’s later and alternative living sectors - encompassing Build-to-Rent (BTR), retirement living, care homes, student accommodation, and co-living - are poised for a dynamic 2025.

With demographic shifts, changing housing preferences, and strong investor demand at their core, these sectors are set to deliver resilience and opportunities despite broader market challenges.

Living sectors we cover

Build to Rent (Multi-family)

In city centres with universities, strong transport links and many young professionals, schemes range from high‑amenity buildings to simpler blocks, supported by on‑site community events.

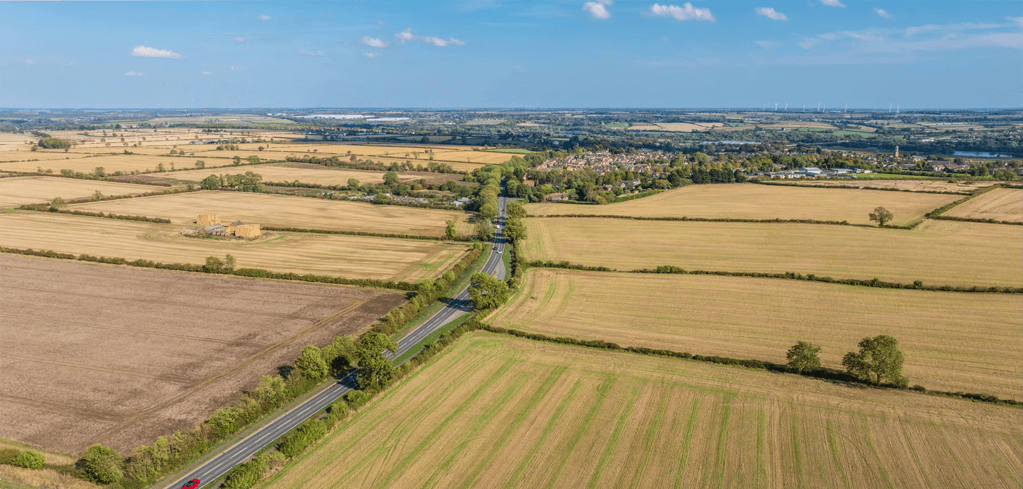

Suburban Build to Rent (Single family housing)

Often individual houses or low‑rise suburban flats, these schemes are less dense but share BTR’s strong community focus, offering flexible tenancies, high service levels and sustainable living.

PBSA (Student housing)

Professionally managed, high‑quality student accommodation, owned by institutional investors, offering cluster flats or studios with shared social areas and strong onsite management.

Co-living

Co‑living is a fast‑growing rental sector between PBSA and Build to Rent, offering shared amenities and activities that build community. It appeals to students and young renters in major cities.

Later living (Retirement rentals)

Flexible retirement renting is expanding through modern retirement rental villages, offering extensive amenities and strong onsite management to foster vibrant communities.

Institutional portfolios

Residential portfolios remain attractive to institutional capital and deliver long‑term returns despite market headwinds. We provide specialist advice, research and management for investors and developers.

Solutions we deliver

Living Capital Markets

We support Capital Markets and investment needs across the Living Sectors, providing transaction, advisory and alternative capital services and handling complex forward‑funding deals.

Living advisory & consultancy

We provide research, underwriting, viability and local area analysis across the Living Sectors, supporting the cycle from planning and design to leasing, mobilisation and better results too.

Operational living

Living Sector operational support and management with hands‑on experience in leading UK BTR portfolios. Our award‑winning team deliver mobilisation, handover, leasing and community services.

Top enquiries

Who lives in Build to Rent (BTR) schemes?

Large Multi-Family city centre BTR schemes attract mainly young professionals, and mature students. As the BTR sector has matured, significantly higher levels of investment have been targeted toward Single Family Housing in suburban areas, which favours more traditional family groups and a marginally older demographic, who value external space and the allure of living in a house.

How do I gauge demand for Living Sector schemes?

For Living Sector investors, the challenge of establishing the depth of market for a type of housing, and whether that demand will be sustained over multiple years is complex. We use a combination of data sources to map the local market. investigate housing pipelines, current level of demand, forecast population growth, employment growth and future shape of the local rental market.

How much is my scheme of rented flats or houses worth?

We utilise a standardised approach to appraise and understand the value of your scheme. We establish the market rental level of the portfolio through mapping out the local market and applying comparable pricing. Taking into account known or forecast operational costs then allows us to establish a net operating income, which can have a yield applied to establish a market valuation.

Meet the team

- Loading...

- Loading...

- Loading...

- Loading...

Est. 1855

Leading the property industry for over 160 years

700+

Property experts working acrosss the UK

20,000

Active registered buyers and tenants on our database

99.6%

Asking price achieved

Need more tailored advice. Get in contact with your local office.

Our local offices will get in contact with you to discuss this with your further.